One might be forgiven for thinking that the turbulence unleashed by Donald Trump’s trade policies during his first term as president of the United States was overhyped—especially since Bangladesh’s export contraction between July 2019 and February 2020, in the aftermath of the US-China trade war that saw tariffs imposed on some $550 billion of Chinese goods and $185 billion of US goods, was soon eclipsed by the unparalleled economic disruptions brought about by the Covid pandemic. Yet, Trump 2.0 could herald a history-repeating moment akin to the 1930 Smoot-Hawley Tariff Act, which raised US import tariffs on approximately 900 products from an average of 38 percent to over 60 percent, provoking retaliation from more than 25 trading partners, crippling global trade, and deepening the recession in global economies.

As proposed, President Trump’s second term may witness US tariffs escalating to an unprecedented 60 percent on imports from China—a country with which the US has maintained a bilateral trade volume exceeding $700 billion—an action that will undoubtedly reshape their economic relations, disrupt global supply chains, and inflate manufacturing costs worldwide. Furthermore, the administration’s plans include imposing tariffs of 25 percent on imports from Canada and Mexico, the United States’ closest trading partners, alongside a sweeping 10 to 20 percent uniform tariff on imports from all other nations, signalling a comprehensive departure from the norms of liberalised trade. Such an unparalleled escalation in tariffs will reverberate across the global economy, igniting trade conflicts, destabilising markets, and compelling nations to reassess long-standing trade alliances in an era where China’s rise challenges US supremacy, triggering an intensification of economic nationalism as a response.

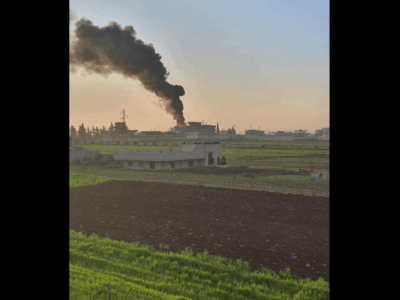

GLOBAL TURMOIL: WIDER RAMIFICATIONS FOR BANGLADESH

Beyond tariffs, the weakening of multilateralism, exacerbated by President Trump’s focus on bilateralism and criticism of the multilateral trading system under the WTO, poses significant challenges to global trade norms. With the rules-based multilateral framework increasingly undermined by geoeconomic strategies, non-power economies like Bangladesh face heightened uncertainty in accessing predictable and preferential trade systems to enter international markets as well as resolve disputes.

Bangladesh’s challenges and opportunities arising from President Trump’s second term will depend on the resultant outcomes endured by the global economy. While many consider hiking tariffs to be just threats or negotiating tools for achieving foreign policy objectives that might not actually be implemented, the first term of his presidency did demonstrate proactive actions, particularly against China, setting new norms of US trade policy that continued to be pursued by the Biden administration. If new Trump tariffs are imposed on China and numerous other countries as feared, some estimates suggest the global economy could shrink by 0.8-1.3 percent, and global trade by three percent. Asia, accounting for 60 percent of global growth, would be hit hard by a trade war between the United States and China.

If uniform tariff rates are imposed on all suppliers to the US, Bangladesh’s exporters may retain their relative competitiveness, but the overall impact is expected to be negative due to reduced trade flows as tariffs raise prices and dampen demand. On the other hand, if significantly higher tariffs are levied on China only, Bangladesh could benefit from trade diversion as global buyers seek alternative suppliers.

However, these potential gains may be subdued or entirely offset if widespread trade wars lead to a reduction in global income and spending.

Furthermore, as many economists argue, Trump tariffs raise production costs and consumer prices in the US, exacerbating inflationary pressures. Evidence from post-Covid stabilisation measures in developed countries suggests that, in periods of high inflation, consumers disproportionately cut back on discretionary spending, particularly on clothing and footwear.