WASHINGTON— Two U.S. senators looking to crack down on the number of packages from China that enter the country duty-free are calling on President Joe Biden to take executive action, saying U.S. manufacturers can’t compete with low-cost competitors they say rely on forced labor and state subsidies in key sectors.

U.S. trade law allows packages bound for American consumers and valued below a certain threshold to enter tariff-free. That threshold, under a category known as “de minimis,” stands at $800 per person, per day. The majority of the imports are retail products purchased online.

Alarmed by the large increase in such shipments from China, lawmakers in both chambers have filed legislation to alter how the U.S. treats imports valued at less than $800. Now, Sens. Sherrod Brown, D-Ohio, and Rick Scott, R-Fla., have sent a letter to Biden calling on him to end the duty-free treatment altogether for those products.

“The situation has reached a tipping point where vast sections of American manufacturing and retail are at stake if de minimis is not immediately addressed,” the senators wrote.

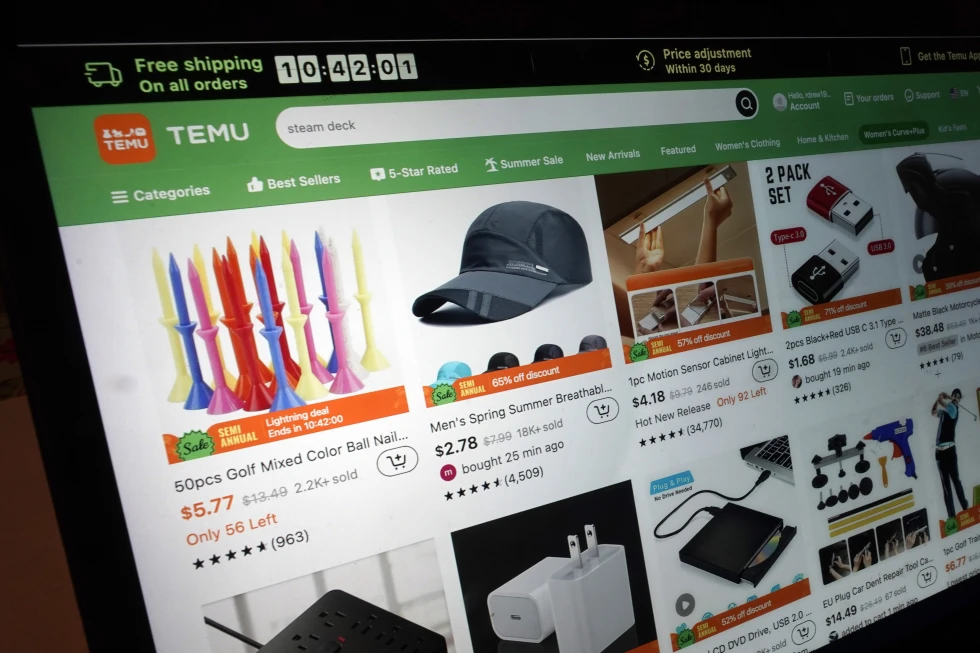

Brown and Scott singled out Temu, Shein and AliExpress in their letter as companies that “unfairly” benefit from the duty-free treatment of their goods. The surge in shipments, they said, hurts big box stores and other retailers in the U.S.

“This out-of-control problem impacts the safety and livelihoods of Americans, outsourcing not only our manufacturing, but also our retail sectors to China, which — as you know — systematically utilizes slave labor among other unconscionable practices to undermine our economy,” the senators said.

The White House referred questions to the Office of the U.S. Trade Representative, which did not immediately respond to a request for comment on the letter provided to The Associated Press.

Congress raised the threshold for expedited and duty-fee imports into the U.S. from $200 back in 2016. The argument for doing so is that it speeds up the pace of commerce and lowers costs for consumers. It also allows U.S. Customs and Border Protection to focus its resources on the bigger-ticket items that generate more tariff revenue for the federal government.

The change in duty-free treatment has led to a significant increase in “de minimis” shipments, from about 220 million packages that year to 685 million in fiscal year 2022.

The higher $800 threshold for duty-free treatment has strong backing from many in the business community. John Pickel, a senior director at the National Foreign Trade Council, a trade association that represents a broad range of companies, said that doing as the senators are urging would increase the amount of time it takes for shipments to arrive as they go through a more cumbersome inspection process at the border. And those products would cost more.

“The increase from $200 to $800 has not really been a significant driver in terms of volume,” Pickel said. “What’s really driving interest in the use of de minimis is the desire for consumers to access their products quickly and at a lower transaction cost.”

He said the average shipment that comes into the U.S. through the de minimis category is $55. But that cost would roughly double for the consumer if de minimis treatment no longer applied because importers would have to hire a customs broker and pay additional processing fees and the import duty.

A trade group representing the textile industry said it agreed with the need for the Biden administration to take executive action on duty-free packages.

“The impact on the U.S. textile industry has been devastating. The industry has closed 10 plants in the past four months, in part due to the unfettered flow of imports coming in through the de minimis loophole, which is undermining our industry and workforce,” said Kim Glas, president and CEO of the National Council of Textile Organizations.